Credit, debt & financial issues

The content on this site is information only and is not legal advice. If you need legal advice please contact us.

Get help to sort out your financial concerns

Financial issues can have a dramatic impact on your life, especially in tough economic times. You may experience intense strain, with no ability to escape or unwind. If you’re experiencing financial stress, there are many legal options to relieve the burden. Ask us how.

Credit issues

What are credit issues?

Credit issues concern borrowing money and credit card use. They can arise when you’re applying for a loan or credit card, but your application is rejected, possibly because of:

- Lack of credit history

- Poor credit history

- Fraud or identity theft

An increasingly common credit issue is when a person with a loan or credit card struggles to repay the money owing. This can lead to poor credit history, debt collection or even bankruptcy.

Sometimes, a change in circumstances can affect your ability to repay a loan or credit card debt. For example, you lose your job, or your business is struggling.

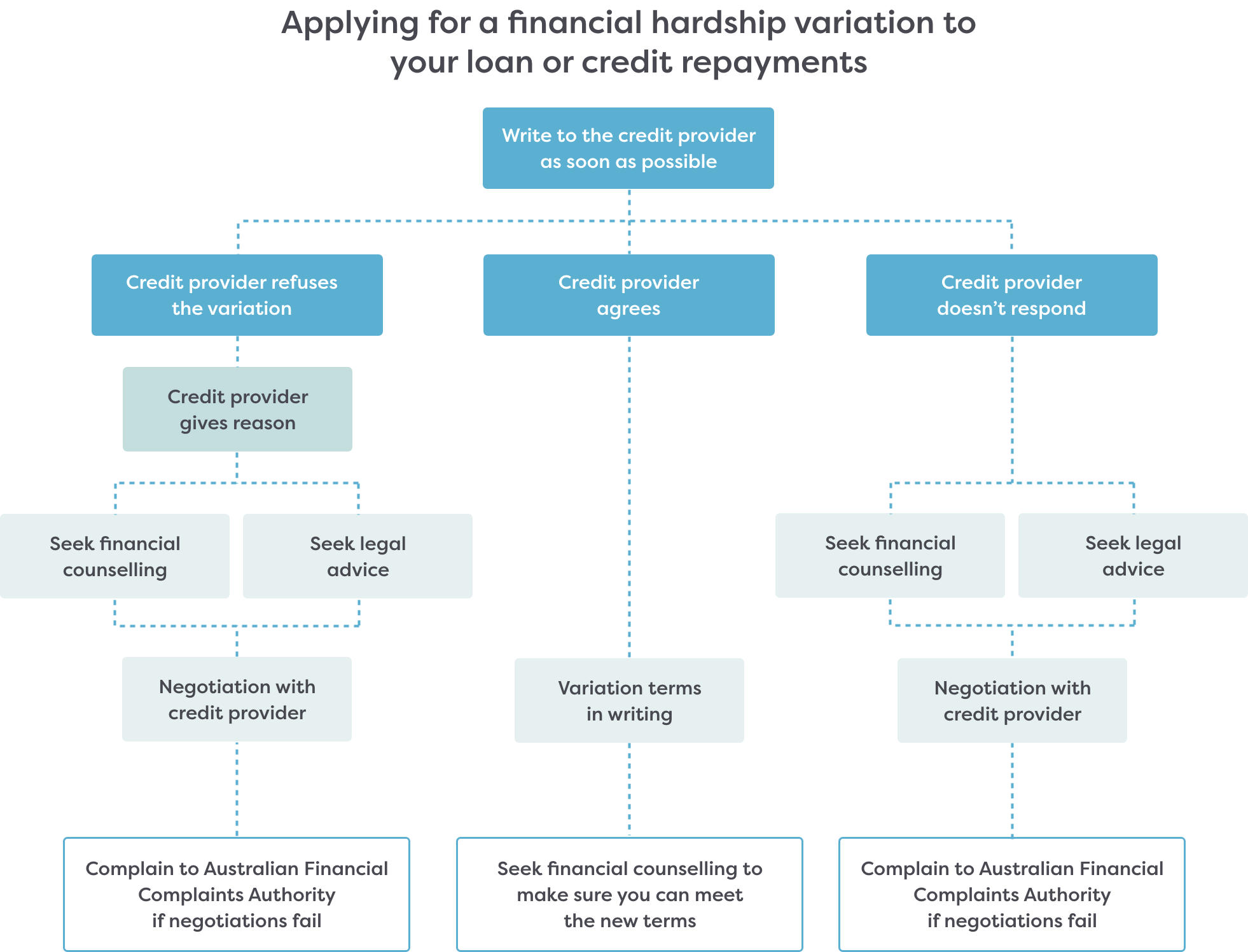

If you’re struggling to repay a debt due to a change in circumstances, we recommend contacting your credit provider as soon as possible, preferably in writing (for example, email). You can ask for a variation to your loan (or other payment plan) due to financial hardship. Your credit provider usually has 21 days to respond.

You have the right to ask for a financial hardship variation to any loan contract which you’re temporarily unable to pay. A variation may give you more time, or allow you to make smaller payments over a more extended period.

If you’re unhappy with the credit provider’s response, or you’re concerned about the potential response, you should seek free financial counselling as soon as possible. Often, financial counsellors can give you excellent strategies for managing your finances and for communicating with credit providers. The sooner you act, usually the better the outcome. You can also speak to us for free legal advice.

If you borrowed money even though you couldn’t afford the loan, you have legal rights. Australian consumer credit protection laws make it illegal for a credit provider to offer you a loan you can’t afford. Credit providers are organisations which provide loans, for example, banks, credit unions and other financial organisations.

The laws also limit the fees and interest that credit providers can charge.

If the credit provider breaks the law, you can complain to the Australian Financial Complaints Authority (AFCA). In some circumstances, AFCA can reduce the amount of the loan by removing all fees and interest. Sometimes, it can arrange for the entire loan to be waived (set aside), meaning you don’t have to repay it.

If you register a complaint with AFCA, the credit provider must not take any action to collect or recover the loan while the complaint is being assessed.

If you’re not sure where to get help, contact us to make an appointment.

You are liable for any debt if you and your former partner signed a loan agreement together, including joint credit cards.

As soon as possible, advise the credit provider that you have separated. It’s best to do this in writing, for example, by email. Let them know if you’ve changed address and cancel any ability to redraw money from the loan, or any line of credit associated with the loan.

It’s easiest if one of you takes over the loan completely, buying the other person out of their interest. Another way is to agree to pay back (discharge) the loan as soon as possible. For example, you may be able to sell something to give you enough money to discharge the loan.

You may wish to deal with the loan as part of your financial settlement with your former partner. For more information, see our Family Law Property Settlement.

In some circumstances, a loan can be in your name only, or in joint names with you and your ex-partner. However, if you never received any benefit from the loan, you may also have legal options against the credit provider or lender, especially if:

- You were forced into the loan; or

- It was obtained using fraud; or

- There was family violence in the relationship

Often, these situations aren’t so straightforward, and you’ll need some help to find your way through this issue. We can give you advice about what steps you need to take.

It’s also a good idea to see a financial counsellor for help.

If you’re struggling to repay your payday loan, you can contact the credit provider and ask to make a change to your payment terms. You may be able to negotiate a more extended period in which to pay. We recommend you do this in writing, for example, by email.

Australian credit laws require that a credit provider must not make a loan agreement with you if you can’t afford the repayments. Also, there are limits on the fees and interest that a credit provider is allowed to charge you for a payday loan.

If you believe the credit provider shouldn’t have loaned you money, contact us as soon as possible to discuss your options. You can complain to the Australian Financial Complaints Authority (AFCA). AFCA may reduce or cancel your loan repayments.

Afterpay and Certegy are types of buy now, pay later services. At first, these services seem attractive, because you receive your purchase immediately (rather than having to wait to pay it off, which is how laybuy works), and because these services usually say they don’t charge interest. However, there are often other fees and charges, and if you don’t pay your instalments on time, you’re charged late fees which quickly add up.

Unlike loans, consumer credit laws don’t apply to these types of services, so they can offer you a buy now, pay later arrangement without checking whether you can afford the repayments. Also, they’re not required to let you change your payment arrangements if you request it.

If you use this type of service and then find you can’t make the repayments, the fees will rapidly increase, especially if the service company decides to refer the matter to a debt collector.

Buy now, pay later debts have caused significant difficulty for many people, especially during the COVID-19 pandemic.

A good example of a purchase with long-term repayments is a mobile phone plan which includes a mobile phone handset.

You can get in touch with your provider and advise them of your situation. They may be able to suggest some options to get your repayments under control, for example swapping your plan for a pre-paid service. For more information about possible options, see the National Debt Helpline’s information about phone and internet bills.

If you’re not happy with the service provider’s response, you can contact us for free legal advice, or get some free help from a financial counsellor.

You can also complain to the Telecommunications Industry Ombudsman (TIO). Usually, the TIO can only help if the cause of your complaint is less than two years old. For more information, visit TIO’s website.

For other types of long-term payments, you can write to the service provider asking to vary your payment terms. If you’re not happy with the service provider’s response, you can contact us for free legal advice, or get some free help from a financial counsellor.

Because credit providers aren’t allowed to offer you a loan you can’t afford, you can also complain to the Australian Financial Complaints Authority (AFCA). AFCA may be able to reduce the loan or cancel the repayments.

When you’re a guarantor for someone else (the borrower) you make a guarantee to the credit provider that you’ll repay the loan if the borrower defaults. (A default is a failure to make some or all of the loan repayments).

For this reason, being a guarantor is a serious undertaking, and you should carefully consider:

- Whether it’s the right thing for you to do; and

- Whether you can afford to pay the loan if the borrower defaults

When you become a guarantor, you must do so freely and without pressure. You must be fully informed of what you’re doing and the consequences for default.

If you’re pressured into guaranteeing a loan, or if you didn’t understand the agreement, you need urgent legal advice to find out whether your guarantee is valid. If it’s not valid, the credit provider can’t make you repay the loan. To learn more, contact us for a free appointment.

If the guarantee is valid, you will probably have to repay the loan. However, before you do so, contact us for free legal advice, or get free advice from a financial counsellor.

For more information, see MoneySmart’s website page, Going guarantor on a loan.

Valerie’s problem, guaranteed

For several decades, Valerie worked as a nurse to pay off the mortgage on the family home.

After she retired, her son Wayne started to pressure her to help him out financially. Wayne was verbally abusive and made threats to harm Valerie if she didn’t cooperate.

Wayne had also started a business and asked Valerie to sign a guarantee. It included her home as a secured asset. This meant that if Wayne failed to make the loan repayments, that the bank could sell the home.

Wayne organized everything through his own mortgage broker. Valerie came to the final appointment with the broker to sign the guarantee. Neither the broker nor the bank advised Valerie to get independent legal or financial advice before signing the documents. Valerie signed the documents without seeking the advice.

Eight months later, Wayne’s business failed and he had no money to pay the debts. The bank used the guarantee to demand that Valerie pay back the loan. It told her that it would sell her house if she failed to pay.

Valerie was distressed. She saw a lawyer at Barwon Community Legal Service and explained everything that had happened. The lawyer helped Valerie complain to the Australian Financial Complaints Authority (AFCA) that both the broker and the bank had failed to comply with their responsibilities. They should not have accepted a guarantee from Valerie because they should have recognised the signs of coercion. Also, they should have ensured that Valerie had independent legal and financial advice.

At first, the broker and the bank didn’t agree, but eventually AFCA found that the guarantee was unenforceable against Valerie. Valerie was allowed to keep her home.

Debt issues

What is a debt?

A debt is money that you owe, or is due to be repaid. It’s not a payment that you make immediately, such as paying for groceries at a supermarket. It’s a payment that you make later, also known as a deferred payment. Examples of debts are mortgages, personal loans, electricity bills and Afterpay purchases.

If you haven’t made any repayments on your debt for six years or more, the law regards the debt as too old for a creditor to take legal action to recover the money. (A creditor is a person or organisation which loaned you the money.)

The six year period starts from the last time you made a repayment or acknowledged the debt in writing. However, if there’s a Court judgment against you for the debt, this six-year period doesn’t apply, and the creditor instead has 15 years to enforce the Court judgment against you.

The time limit is longer for mortgages and other secured loans. A secured loan is a loan in which the asset is security for the loan. If the borrower defaults on the repayments, the lender can take possession of the asset, for example, a mortgage over a house.

For mortgages and secured loans, a lender can’t take legal action to recover the debt if you haven’t made any repayments for at least 15 years, except if there’s a Court judgment allowing the creditor to pursue the debt.

If a creditor tries to take legal action against you for non-payment of the debt, you can use the time limits (of six or 15 years) as a defence to any legal claim.

The time limits don’t apply to government debts, such as Child Support, Centrelink/Services Australia, of fines issued by a Court or Victoria Police. Please see our other pages for information about these areas of law.

If a company, financial institution, or debt collector contacts you claiming that you owe a debt, there are four steps to follow:

- Do NOT admit to owing the debt

- Ask for evidence (proof) of the debt

- Do NOT make any payment

- Seek legal advice immediately

We can give you free legal advice about an old debt. Contact us to find out how we can help.

It’s essential that you DON’T admit to the debt and that you DON’T pay any money towards the debt without first getting legal advice. Admitting the debt or paying money may mean that the six (or 15)-year period will start again, opening up an opportunity for the creditor to take legal action to recover the debt.

If the creditor continues to contact you about an old debt after you have told them not to, they may be breaking debt collection laws.

Anna’s old debt

Twelve years ago, Anna found herself in some financial difficulties. She had borrowed $5,000 to do some training to further her career as a freelance photographer. At the time, Anna was self-employed. Shortly after completing the training, Anna broke her arm and shoulder and was unable to work for a year. During this time, she struggled to pay her expenses but made a payment plan with the lender to make small regular payments until $4000 was repaid. The lender agreed to accept $4000 as payment in full.

Anna made all the agreed payments on time until she’d paid $4000. She believed the debt was discharged.

However, a month ago, Anna was contacted by a debt collection agency demanding that she pay another $1000 to discharge the debt.

Anna was concerned about this and asked the agency what evidence they had of the debt. While she waited for the agency’s response, she contacted Barwon Community Legal Service to find out what she could do. Our lawyer advised her not to pay the debt, and not to admit owing any debt. The six-year limitation period may mean the agency couldn’t take legal action against her. The lawyer asked Anna to make an appointment as soon as she received the documents from the agency.

If you were pressured into going into debt because you were in a family violence situation, you may be able to have your name removed from the debt.

If you feel comfortable, you can contact the credit provider to discuss your situation. Make sure the credit provider doesn’t share any personal information with the other person. Discuss whether you can make any repayments without the other person’s involvement. You may be able to make a repayment plan with the credit provider.

If you can’t make repayments, or if you don’t feel safe enough to contact the credit provider, contact us for urgent legal help. Our service is free of charge.

If the credit provider doesn’t respond or rejects your request, or if the situation is urgent, you can complain to the Australian Financial Complaints Authority (AFCA). In some circumstances, AFCA can reduce the amount of the loan by removing all fees and interest. It may also waive (set aside) the debt, meaning you don’t have to repay it.

If you complain to AFCA, the credit provider must not take any action to collect or recover the loan while the complaint is being assessed

Debt collectors are sometimes engaged by credit providers to collect payment of debts, or to repossess (reclaim) your personal property to pay off the debts. They may:

- Contact you on behalf of a company or lender; or,

- Have purchased your debt from the company or lender and are now tryng to collect it for themselves

If the debt collector says they purchased the debt from a company or lender, ask them for proof. They should be able to show you a Notice of Assignment, which serves a proof that the debt is yours and they are lawfully collecting it. Don’t pay any debt collector debts without first seeing a Notice of Assignment.

Victoria has strict rules about debt collection. A debt collector must not:

- Harass you

- Make threats

- Use lies or deception

- Use misrepresentations

These practices are known as banned debt collection practices. If a debt collector uses these tactics, you can complain to Consumer Affairs Victoria.

You can also apply for compensation in the Victorian Civil and Administrative Tribunal (VCAT).

If the debt collector is acting fairly, you should work out what you can afford to pay. You can use this information to have a discussion with them. You can seek free help from a financial counsellor, or contact visit the National Debt Helpline (NDH) which offers a free live chat service and can refer you to a free financial counsellor.

If you believe you don’t owe the debt, you’ll need legal advice. Contact us as soon as possible.

Start by asking the debt collector for proof of the debt. The debt collector is required to stop trying to collect the debt until they have provided you with this information.

Once you have the information, you can decide whether to provide some identification to the debt collector to prove that it’s not your debt. You can do this with a driver’s licence, or some other photo identification.

If the debt collector refuses to accept that you’re not the person who owes the debt, contact us as soon as possible for free legal advice. If debt collector’s phone calls are harassing, you may be entitled to complain to Consumer Affairs Victoria about their conduct, or apply for compensation in the Victorian Civil and Administrative Tribunal (VCAT).

If you bought a product or service but;

- You didn’t receive it; or

- It was faulty; or

- It wasn’t what you ordered,

you may be able to get a refund or compensation. Consumer laws protect you from having to pay a debt in these circumstances. For more information, visit:

A credit rating is also known as a credit score.

Credit ratings are important because they’re used by credit providers to decide whether they will give you a loan. Your personal and financial information is used to create your credit score. For example, whether you’ve borrowed money in the past, whether you repaid the loan on time, how many credit applications you’ve made.

You can get free information about your credit rating. For more information, see MoneySmart’s webpage, Credit Scores and Credit Reports.

You can get a free copy of your credit report by contacting a credit reporting agency. Visit the MoneySmart website to learn more about how to get a free credit report.

Your credit report will include your personal details, as well as:

- Information about your loans and credit cards

- Your repayment history

- Whether you’ve defaulted on any bills, loans or credit card payments

- Your credit card applications

- Any bankruptcy and debt agreements

- Your previous requests for credit reports

For more information about credit reports, see the MoneySmart website.

If your credit report has mistakes, you can apply to get them fixed, free of charge. For more information, visit MoneySmart’s information about credit repair.

If you’re concerned about inaccurate information in your credit report which can’t be repaired, contact us for legal help.

If your credit report is correct, but your credit score is poor, you should see a free financial counsellor, who may be able to help you improve your score. We don’t recommend using a private debt or budget management firm, as most will charge you a fee.

There are also private companies which advertise that they can clean up your credit report. These companies can charge many thousands of dollars in fees and leave you further in debt. Instead, see a qualified financial counsellor. Many financial counsellors offer free government-funded services.

Visit the National Debt Helpline’s website to find a free financial counsellor.

Under Australian law, you’re allowed to apply for bankruptcy if:

- You can’t pay your debts on time; and

- You live in Australia

So long as you meet these criteria, you can apply for bankruptcy regardless of how much, or how little, you owe. It doesn’t cost you anything to apply for bankruptcy.

If you’re honest and follow the conditions placed on you, usually bankruptcy will last for three years and one day from the date of your application.

If you declare bankruptcy, in most cases you will no longer be required to pay your debts, such as credit card debts, personal loans, and bills and fees for professional services such as doctors, lawyers and accountants. However, you may still have to pay some government debts.

A bankruptcy trustee will be appointed. They may sell your assets to help pay off your debts, for example, your secured assets such as your house or car.

For more information about what happens to your debts when you’re declared bankrupt, visit the Australian Financial Security Authority website page, What happens to my debts?

If you’re under financial stress, applying for bankruptcy may seem like a reasonable solution to an increasingly severe problem. However, there are some serious consequences for going bankrupt, and some of them are lifelong. For example,

- If you earn income over a certain amount, you may have to pay that money to your bankruptcy trustee

- You must report any changes in income to your bankruptcy trustee

- You won’t be able to hold some types of jobs and public positions

- You can’t be a company director

- You may not be allowed to travel overseas

- Your name will be permanently on the National Personal Insolvency Index, which is a register that’s available to the public

- You may have trouble getting a loan or credit card in the future

- Your bankruptcy trustee can sell your assets

- You may not be able to take legal action during your bankruptcy

To work out whether bankrupty is right for you, you can seek free help from a financial counsellor, or contact the National Debt Helpline (NDH), which offers a free live chat service and can refer you to a free financial counsellor.

For more information about the consequences of bankruptcy, visit the Australian Financial Security Authority’s webpage, Consequences of bankruptcy.

Before you apply for bankruptcy, you should talk to a free financial counsellor. The counsellor can discuss your situation, identify any options and make sure you understand all the consequences of bankruptcy. This is especially important because you can’t change your mind once you’ve applied for bankruptcy.

To work out whether bankrupty is right for you, you can seek free help from a financial counsellor, or contact the National Debt Helpline (NDH), which offers a free live chat service and can refer you to a free financial counsellor.

If you’re seeking a refund or compensation, usually you have six years to make a legal claim in a Court.

If you wish to make a complaint about a credit provider or lender, usually you can do so within two years of the debt, if you complain to the relevant authority. For example:

- For credit and debt issues, you can complain to the Australian Financial Complaints Authority

- For a complaint about your phone or internet service, you can complain to the Telecommunications Industry Ombudsman

- For a complaint about your gas, electricity or water service, you can complain to the Energy and Water Ombudsman Victoria

Time limits can vary, so it’s best to act quickly to seek advice from a financial counsellor or lawyer and to make a claim, even if you think you’re past the time limits.

You’re not alone

We can help you sort out your financial issues and reduce your stress

Call us todayLast modified on April 29th, 2021 at 9:54 am

The content on this site is information only and is not legal advice. If you need legal advice please contact us.